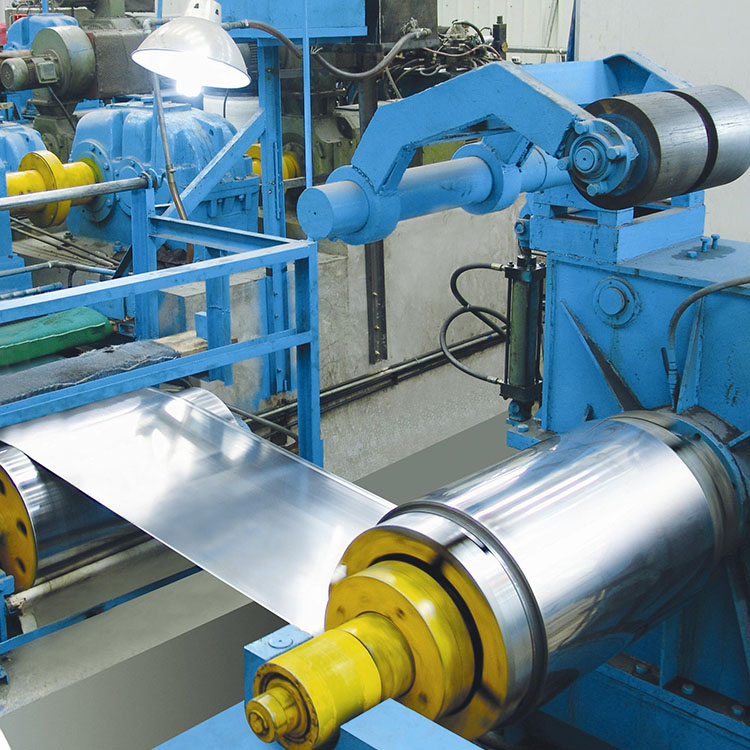

FILE PHOTO-An employee works on rolls of aluminum foil in a shop of the Rusal's SAYANAL foil mill outside the town of Sayanogorsk, Russia, September 3, 2015. REUTERS/Ilya Naymushin/file photo Acquire Licensing Rights

LONDON, July 14 (Reuters) - Europe's aluminium industry group has considered lobbying for European Union sanctions on Russian aluminium, but would oppose specifically targeting the country's largest producer Rusal , according to a document sent to members. 10mm Copper Coil

The head of trade group European Aluminium said it prepared the internal memorandum for planning purposes and had no information about any imminent EU sanctions.

The European Commission declined to comment.

The document, dated July 2023 and seen by Reuters, said members of European Aluminium had discussed the possibility of "actively calling for EU sanctions on Russian aluminium."

But while substituting other supply for Russian ingots would be feasible in Europe, the wide global spread of Rusal's operations makes sanctions on that company more problematic, the memorandum said.

"European Aluminium (therefore) recommends avoiding that EU sanctions would target Rusal as a company," the association said.

Rusal, which did not reply to a request for comment, produced 4 million metric tons of primary aluminium last year, about 6% of global supply.

The document noted that Rusal owns Ireland's Aughinish, the EU's largest refinery of raw material alumina, as well as the Kubal smelter in Sweden.

The benchmark aluminium price on the London Metal Exchange was up 0.2% at $2,282.50 a metric ton in afternoon trading, having declined by 4% so far this year.

The U.S.-based Aluminum Association trade group said it had watched Russia's aggression in Ukraine with "growing alarm", and had been in touch with European Aluminium.

The industry supported any efforts by the U.S. government and allies to address the ongoing crisis, "including new tariffs on aluminum imports from Russia announced earlier this year," it said in a statement.

Russia accounts for less than 3% of U.S. aluminium imports.

The EU has so far restricted imports of only a limited number of specific aluminium products from Russia - aluminium plates, sheets or strip with thickness exceeding 0.2 mm.

Its latest sanctions package was adopted in June and active discussion on another package are not expected in the near term.

In February the United States announced plans to impose a 200% tariff on aluminium and derivatives produced in Russia while in May, Britain published plans to ban imports of Russian aluminium along with diamonds, copper and nickel.

"Our members asked us to consider the issue and this is purely an internal exercise," European Aluminium Director General Paul Voss told Reuters. "There is no suggestion at all as far as I'm aware that the Commission is planning any new sanctions at this stage."

The document says the EU's dependence on Russian aluminium has fallen since 2018, when the United States slapped sweeping sanctions on Rusal, which froze the bulk of the company's exports as well as paralysing global supply chains.

Last year, Russian aluminium ingots made up 12% of EU imports, down from 25% in 2018, it said.

Due to the widespread disruption of the aluminium industry by the 2018 U.S. sanctions, Washington scrapped them in 2019.

If the EU imposed sanctions on Russia, it also must make sure that supply does not evade the measures through third countries, the document said.

"Specific attention should be given to Turkey and China which are seen by several analysts as current and future alternative destinations for Russian metal."

The industry group said any sanctions would need a "reasonable transition period" so alternative sources could be found.

Reporting by Pratima Desai, Eric Onstad and Polina Devitt; additional reporting by Gabriela Baczynska in Brussels and Ernest Scheyder in Houston; editing by Jason Neely, Conor Humphries and John Stonestreet

Our Standards: The Thomson Reuters Trust Principles.

Asian shares slid on Thursday as risk aversion prevailed in the market due to mounting worries over Middle East tensions, while gold prices stayed near two-month peaks with investors seeking safer assets.

Reuters, the news and media division of Thomson Reuters, is the world’s largest multimedia news provider, reaching billions of people worldwide every day. Reuters provides business, financial, national and international news to professionals via desktop terminals, the world's media organizations, industry events and directly to consumers.

Build the strongest argument relying on authoritative content, attorney-editor expertise, and industry defining technology.

The most comprehensive solution to manage all your complex and ever-expanding tax and compliance needs.

The industry leader for online information for tax, accounting and finance professionals.

Access unmatched financial data, news and content in a highly-customised workflow experience on desktop, web and mobile.

Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts.

Screen for heightened risk individual and entities globally to help uncover hidden risks in business relationships and human networks.

2.5mm Aluminium Sheet All quotes delayed a minimum of 15 minutes. See here for a complete list of exchanges and delays.